Sea freight prices skyrocket: Shanghai to Rotterdam has seen the largest increase in freight rates

The price of spot containers is showing a straight upward trend, and the increase this month is comparable to the beginning of the Red Sea shipping crisis, and even the beginning of the coronavirus pneumonia epidemic.

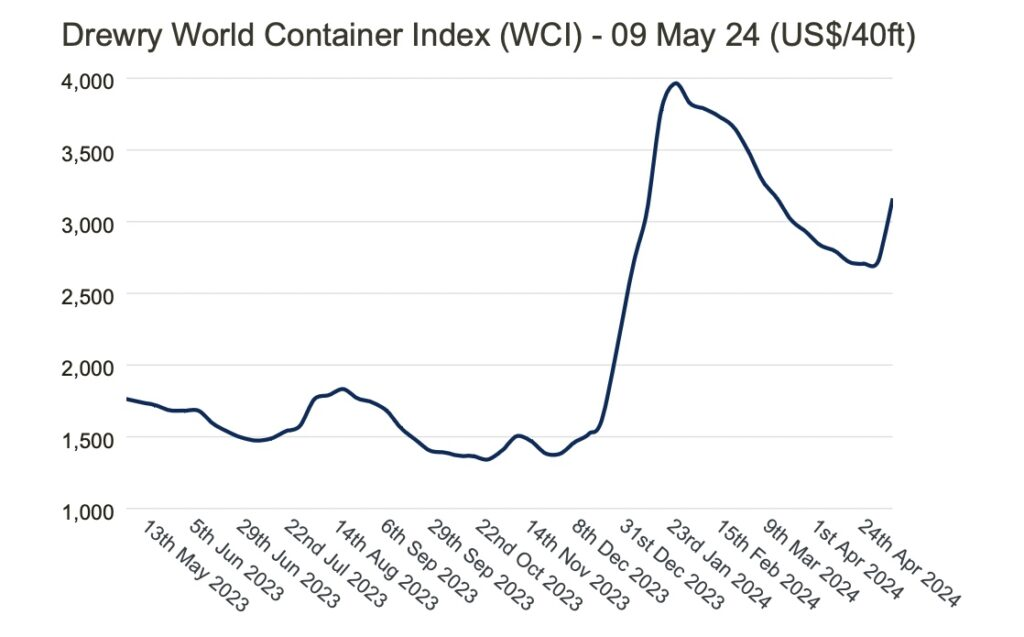

The weekly composite global index released by Drury yesterday rose 16% to $3159 per FEU, an 81% increase compared to the same period last year.

The average composite index so far this year is $3227 per feu, which is $512 higher than the 10-year average interest rate of $2714, and the abnormal period of COVID-19 from 2020 to 2022 pushed up the 10-year average interest rate.

The freight cost from Shanghai to Rotterdam has increased the most, with a 20% increase or $606 to $3709 per feu. Similarly, the price from Shanghai to Los Angeles increased by $617 to $3988 per feu, representing an 18% increase.

Drury said yesterday that he expects freight rates outside of China to continue to rise in the next week due to "surge in demand and tight transportation capacity.".

This week, analysts from investment bank Jefferies pointed out that "container freight rates continue to rise significantly, and after a period of strong regular route traffic and limited fleet size due to Red Sea reroutings, peak season traffic is approaching.". Jefferies pointed out that global trading volume has significantly rebounded since the typical off-season in February/March, and predicts that peak season activity may support prices in the next two to three months.

Many analysts point out that many important ports around the world are becoming increasingly congested, which helps explain the rising freight rates and the ongoing Red Sea shipping crisis.

According to BIMCO, the shipowner organization, it is estimated that managing global container trade would require an increase of approximately 10% in transportation capacity due to the fact that ships need to divert through Cape of Good Hope after the Hussai organization launched an attack in the Red Sea.

An analyst from consulting firm Linerlitica pointed out in the latest weekly report that "the container freight and chartering markets continue to be bullish, with carriers pushing for further interest rate hikes before May, while demand for ships remains undiminished." He added that concerns about overcapacity are currently "secondary."

"If the price increases remain unchanged, they will reflect already tight transportation capacity, while demand is experiencing a somewhat unexpected and out of season increase," said Judah Levine, research director at booking platform Freightos.

In Nordic countries, Levin described the situation of tight transportation capacity and container rolling, which may be due to European importers starting to replenish inventory.

Regarding trans Pacific trade, Levin stated that signs of increased imports include reports of some railway congestion in imported goods at ports in Los Angeles and Long Beach, while shippers are nervously monitoring potential railway strikes in Canada later this month and labor issues at some ports in the United States.

"As April and May are usually the off-season for ocean freight, the increase in freight volume now may reflect some shippers bringing forward peak season freight, as they are concerned that the diversion of the Red Sea or potential labor disruptions at the East Coast and Gulf ports may cause delays during normal peak seasons," Levin suggests.

The strong growth of spot wealth is also reflected in the chartering market. Brokerage firm Braemar pointed out, "Strong market activity continues to exist, with almost all vessel sizes continuing to rise."

Tonnage supply is rapidly decreasing, and the market lacks real-time vessels, leading operators to seek more advanced positions.